|

|

Theoretical Basis

This program uses the portfolio theory developed by Harry Markowitz in 1952 and the extension to that theory developed by James Tobin in 1958.

Markowitz observed that the predictability of the return from a collection of investments can be more accurately assessed by considering the investments in combination rather than individually.

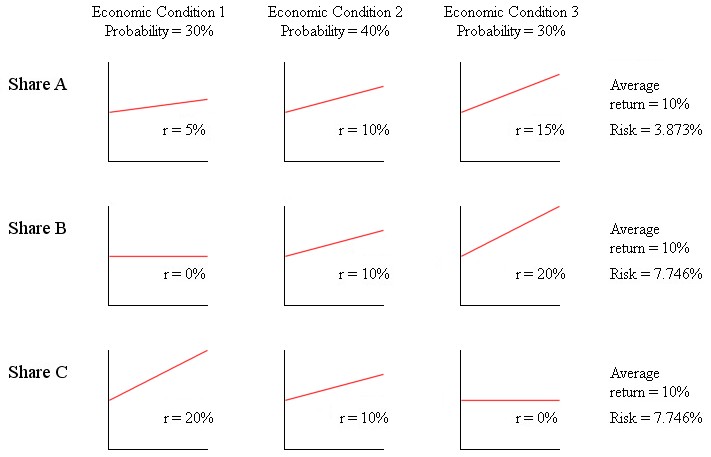

To illustrate, let us suppose there are three shares, A, B and C, that we are considering for a portfolio, and that over three time periods, representing certain economic conditions, the return and variability (or 'risk') of return of each share are as below:

|

|

|

|

The average return for each share is calculated as the mean:  , while the risk is calculated as the standard deviation: , while the risk is calculated as the standard deviation:

The return and risk for combinations of shares are calculated similarly, for instance, in considering a portfolio containing 50% share A and 50% share B the return would be  and the risk would be and the risk would be

In the above example a 50:50 holding of share A and share B would yield a return of 10% with a risk of 5.81%. However, a 50:50 holding of share B and share C would yield 10% with a risk of 0%.

Share B and share C are, in fact, perfectly negatively correlated and their variabilities cancel out.

|

|

|

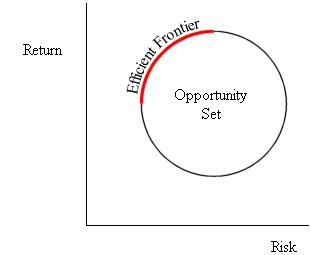

The Opportunity Set

Plotted on a graph of return versus risk the various possible combinations of holdings give a range of values called the opportunity set. Portfolios containing combinations of share-holdings that give the best possible return for a given level of risk are found on the efficient frontier.

|

|

|

|

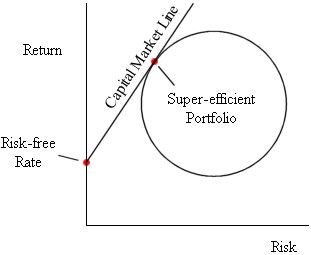

The Super-Efficient Portfolio

James Tobin advanced portfolio theory by adding consideration of a risk-free asset. Using the risk-free rate of return the super-efficient portfolio can be identified. Then, using combinations of the super-efficient portfolio and investment at the risk-free rate, new portfolios can be constructed, leveraged or de-leveraged anywhere along the capital market line.

This program calculates the super-efficient portfolio from the basic inputs.

|

|

|

| |

| |